Retirement marks a significant shift in spending habits, influenced by changes in income and lifestyle. Understanding how retirees allocate their funds is crucial for planning and maintaining financial stability during retirement years.

Statistics and Trends in Retirement Spending

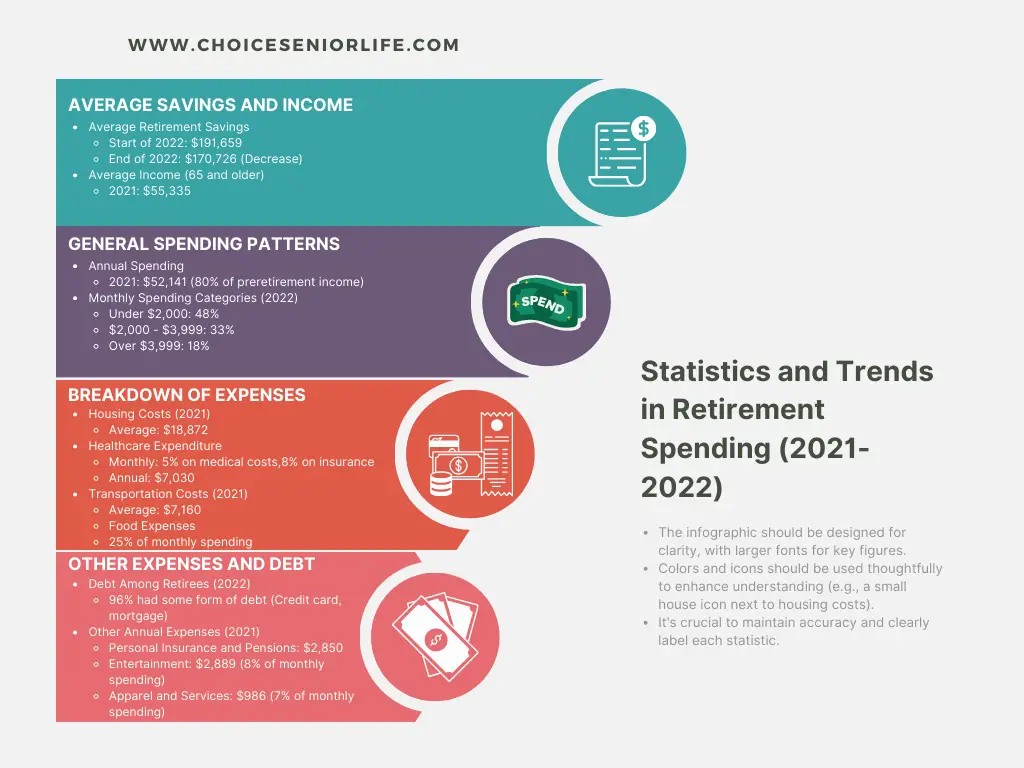

- Average Savings and Income:

- General Spending Patterns:

- Housing Costs:

- Healthcare Expenditure:

- Transportation Costs:

- Food Expenses:

- Debt among Retirees:

- Other Expenses:

Unexpected Retirement Expenses

Retirement often brings unforeseen expenses, which can strain budgets if not anticipated. Some of these include:

- Long-Term Care Costs: Long-term care, not always covered by insurance, can be a significant unforeseen expense.

- Home Maintenance: As property ages, maintenance and repair costs can escalate unexpectedly.

- Healthcare Increases: Healthcare costs, especially out-of-pocket expenses, can rise unexpectedly, influenced by changes in health and insurance coverage.

- Inflation Impact: The cost of living tends to increase over time due to inflation, affecting the purchasing power of retirement savings.

- Supporting Family Members: Financial support for children or grandchildren can emerge as an unplanned expense.

- Leisure and Travel: Increased leisure time often leads to higher spending on travel and hobbies, which may not have been part of the initial retirement budget.

Conclusion

Retirement spending is a complex mix of necessary expenses, lifestyle choices, and unexpected costs. Adequate planning and budgeting, considering both typical and unforeseen expenses, are essential for a financially secure retirement. Being aware of these trends and preparing for potential surprises can help ensure a more comfortable and stress-free retirement period.

Morgan Elfman is a compassionate writer, dedicated caregiver, and passionate advocate for senior well-being. Born and raised with a deep sense of empathy and a natural inclination towards service, Morgan has devoted her life to making a positive impact on the lives of seniors.

As a writer for www.choiceseniorlife.com, Morgan utilizes his skills to create insightful and informative content that addresses the unique needs and challenges faced by seniors and their families. Her articles not only provide valuable information on health, lifestyle, and care options but also strive to inspire and empower seniors to lead fulfilling lives.