Long-term care insurance is an increasingly relevant topic as populations age and healthcare costs rise. This insurance is designed to cover long-term services and supports, including personal and custodial care in a variety of settings such as your home, a community organization, or other facilities.

The Growing Demand for Long-Term Care

- Aging Population: With the aging of baby boomers, the demand for long-term care services is expected to grow significantly. By 2050, the population of people aged 65 and over is projected to nearly double.

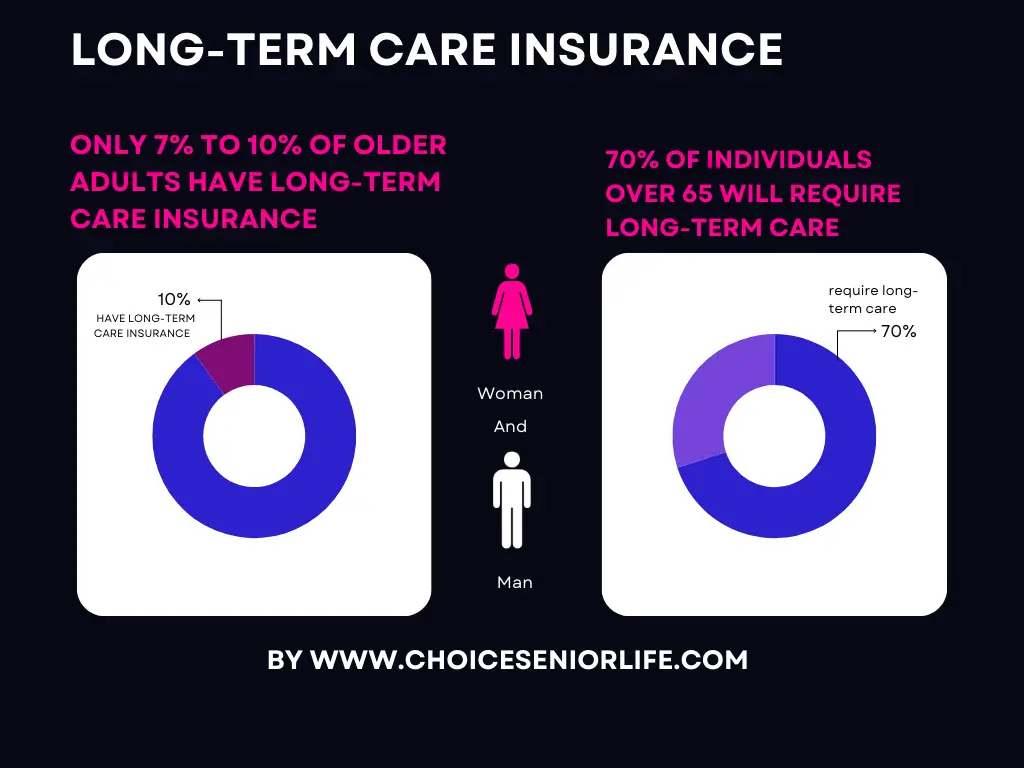

- Increasing Life Expectancy: As life expectancy increases, so does the likelihood of needing long-term care. Statistically, about 70% of individuals over 65 will require some form of long-term care during their lives.

Costs of Long-Term Care

- Rising Costs: The cost of long-term care has been rising steadily. For instance, the annual cost for a private room in a nursing home can exceed $100,000 in some areas.

- Impact on Savings: These high costs can quickly deplete savings, especially for those without long-term care insurance.

Long-Term Care Insurance Coverage

- Policy Holders: A small but growing percentage of the population holds long-term care insurance. As of recent statistics, only about 7% to 10% of older adults have such insurance.

- Benefits Paid: The total amount of benefits paid annually by long-term care insurance providers has been increasing, reflecting the growing need for these services.

Gender and Long-Term Care Insurance

- Gender Disparities: Women are more likely to need long-term care services due to their longer life expectancy. However, they are less likely than men to have sufficient long-term care insurance.

- Caregiving Role: Women are also more likely to be caregivers, which can impact their ability to earn and save for their own long-term care needs.

Challenges and Considerations

- High Premiums: One of the biggest challenges with long-term care insurance is the high premium costs, which can be prohibitive for many, especially in retirement.

- Limited Awareness: There is a lack of awareness and understanding about long-term care insurance, its benefits, and its limitations.

The Future of Long-Term Care Insurance

- Policy Innovations: Insurers are exploring new ways to offer long-term care benefits, including hybrid policies that combine life insurance with long-term care coverage.

- Government Involvement: There is ongoing debate about the role of government in providing or supporting long-term care insurance.

Conclusion

Long-term care insurance is a critical component of financial planning for aging individuals. As the need for long-term care grows, understanding the statistics and trends surrounding this insurance becomes increasingly important for individuals, families, and policymakers.

Morgan Elfman is a compassionate writer, dedicated caregiver, and passionate advocate for senior well-being. Born and raised with a deep sense of empathy and a natural inclination towards service, Morgan has devoted her life to making a positive impact on the lives of seniors.

As a writer for www.choiceseniorlife.com, Morgan utilizes his skills to create insightful and informative content that addresses the unique needs and challenges faced by seniors and their families. Her articles not only provide valuable information on health, lifestyle, and care options but also strive to inspire and empower seniors to lead fulfilling lives.