The aging of the baby boom generation, those born between 1946 and 1964, marks a significant demographic transition with considerable implications for consumer credit and the broader economy. Accounting for nearly a third of the U.S. population, their substantial numbers and accumulated wealth have been pivotal in shaping current economic trends.

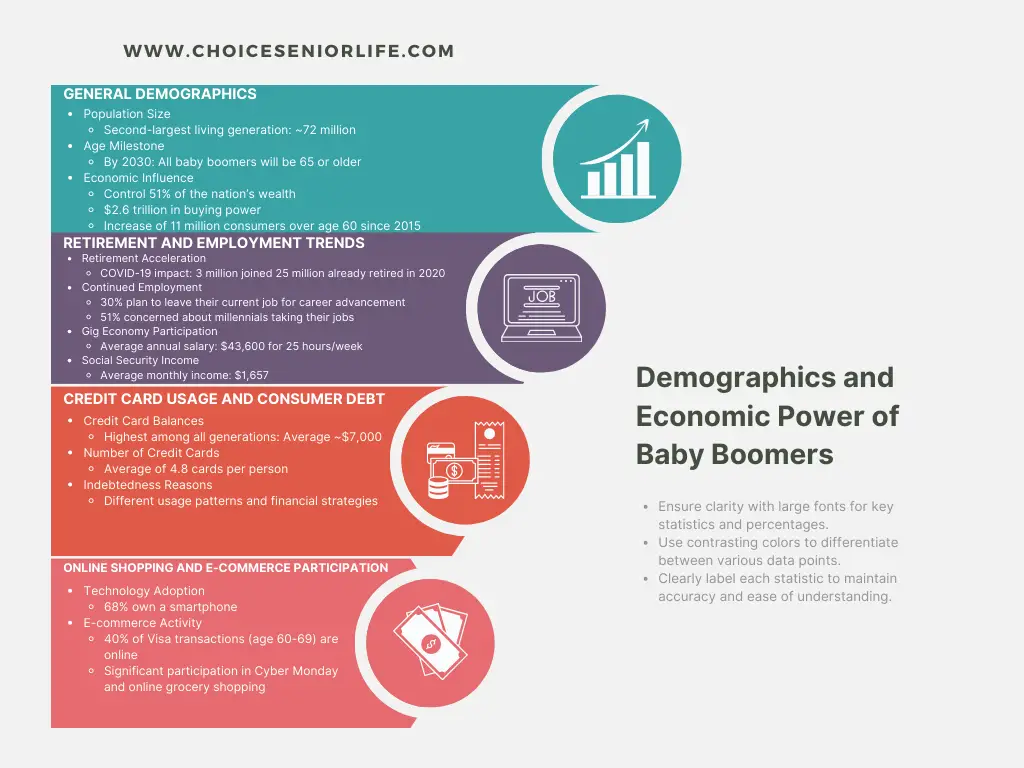

Demographics and Economic Power

- Baby boomers are the second-largest living generation in the U.S., numbering around 72 million.

- By 2030, all baby boomers will be 65 or older.

- They control 51% of the nation’s wealth and possess $2.6 trillion in buying power.

- An increase of 11 million consumers over age 60 since 2015 highlights their growing economic influence.

Retirement and Employment Trends

- The COVID-19 pandemic accelerated retirement among baby boomers, with approximately 3 million joining the 25 million already retired in 2020.

- Despite this, many continue to work, with 30% planning to leave their current job to advance their career, and 51% concerned about millennials taking their jobs.

- The gig economy has become a popular choice, with boomers earning an average annual salary of $43,600 for 25 hours of work per week.

- Social Security income averages only $1,657 each month, underscoring the financial challenges faced by many in this generation.

Credit Card Usage and Consumer Debt

- Baby boomers carry the highest credit card balances among all generations, averaging just under $7,000 in credit card debt.

- They also carry more credit cards, with an average of 4.8 cards per person, compared to millennials’ 3.2.

- This higher level of indebtedness may stem from their different usage patterns and financial strategies.

Online Shopping and E-commerce Participation

- Despite not growing up with technology, 68% of baby boomers own a smartphone, and they are active participants in e-commerce.

- 40% of Visa credit card transactions for consumers aged 60 to 69 are made online without a physical card.

- Boomers are also significant contributors to the economy through their participation in online shopping, including seeking out Cyber Monday deals and ordering groceries online.

Credit Card Use Motivations and Spending Patterns

- The share of boomers using credit cards for shopping is the highest across generations at 74%.

- On average, they spent $477 on credit card purchases in the last 90 days, demonstrating their significant consumer impact.

- Unlike younger generations, baby boomers tend to use credit cards not out of financial necessity but to obtain benefits from reward programs. This trend suggests a more financially secure stance, as they often pay off their credit card balances each month.

The aging baby boom generation is a demographic powerhouse that continues to shape the U.S. economy. Their unique spending habits, employment trends, credit card usage, and participation in the digital economy are key factors in understanding current and future patterns in consumer credit and economic growth. Their significant wealth and evolving economic behaviors underscore their ongoing influence on market trends and credit dynamics.

Morgan Elfman is a compassionate writer, dedicated caregiver, and passionate advocate for senior well-being. Born and raised with a deep sense of empathy and a natural inclination towards service, Morgan has devoted her life to making a positive impact on the lives of seniors.

As a writer for www.choiceseniorlife.com, Morgan utilizes his skills to create insightful and informative content that addresses the unique needs and challenges faced by seniors and their families. Her articles not only provide valuable information on health, lifestyle, and care options but also strive to inspire and empower seniors to lead fulfilling lives.